Which Of The Following Is A Cost Pool Used With The Activity-Based Costing Method?

Which Of The Following Is A Cost Pool Used With The Activity-Based Costing Method?. Activity based costing is used by businesses and manufacturing units for calculating indirect costs involved in making a product. On the basis of benefit received from indirect activities.

Identify the direct costs of the products. The actual overhead cost for the cost pool was ₹ 4,20,000 at an actual activity of 6,000 part types. (a) ₹ 63 per part type.

When Traditional Production Volume Based Overhead Allocations Are Made, Rather Than Activity Based Allocations.

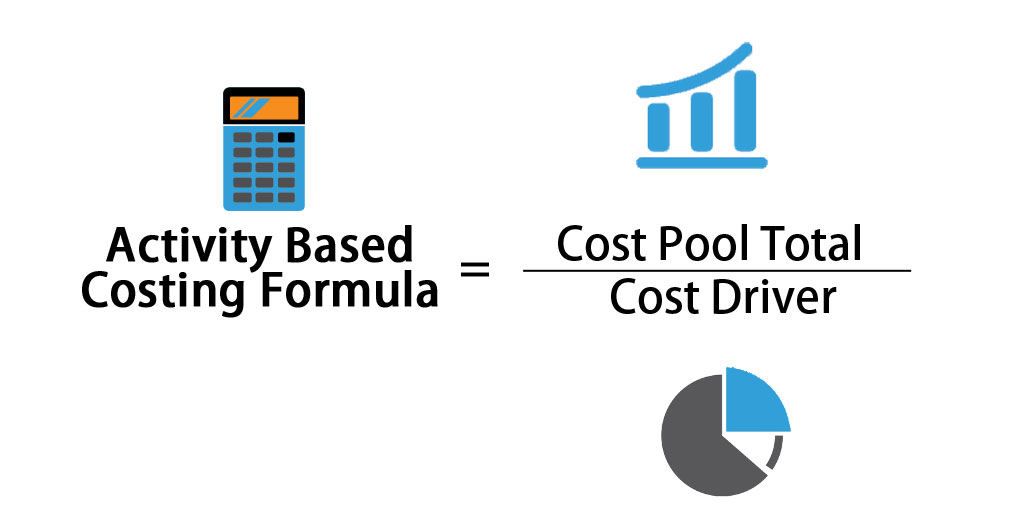

Identify the direct costs of the products. Activity based costing refers to cost attribution to cost units on the basis of benefits received from indirect activities. Identify the cost driver that has a strong correlation to the costs in the cost pool.

(Cost Driver Rate Which Is Calculated By Total Cost Divided By Total No.

This costing method is ideal for identifying the cost of each individual activity in the production process for manufacturing a product involves both direct and indirect costs. An approach to costing and monitoring of activities which involves tracing resource consumption and costing final outputs. The company has provided the following data concerning its costs and its activity based costing system:

If Only One Item Is Represented By An Activity Cost Pool, Then The Cost Can Be Classified As Fixed.

The activity rate used to assign costs for that cost pool was: Abc costing provides more relevant and detailed information as compares to absorption costing which uses direct material hour rate or labor hour rate for calculating a rate that could be used for allocation of overheads. It is a factor that will cause a change in the cost of that activity.

A Cost Pool Should Be Created For Each Activity.

Also, compute the amount of overhead cost that would be applied to each product. The amount of activity for the year is as follows: An activity cost pool is a “cost bucket” in which costs for a particular activity are accumulated.

This Is An Item For Which Measurement Of The Cost Would Require, E.g., A Product.

Compute the overhead rate for each pool. Activity based costing is used by businesses and manufacturing units for calculating indirect costs involved in making a product. Activity making bouquets 60,000 bouquets.

Post a Comment for "Which Of The Following Is A Cost Pool Used With The Activity-Based Costing Method?"